December 7, 2010

The Congressional Budget Office (CBO) now projects that the cost of the Troubled Asset Relief Program (TARP) will be significantly lower than previous estimates. Congress passed TARP in October 2008 to permit the Treasury Department to purchase or insure “troubled assets” that threatened market stability.

CBO estimates TARP will cost $25 billion; the agency’s estimates earlier this year put the figure at $66 billion and $109 billion. Factors in the lower estimate include additional repurchases of stock by recipients of TARP funds, lower estimates of assistance for AIG and the auto industry, lower participation in mortgage programs, and the fact that TARP funds can no longer be used for new purposes.

CBO has also updated its estimate of the American Recovery and Investment Act (ARRA), the stimulus bill passed last year. CBO estimates that the bill will cost $814 billion over 10 years, up from the original $787 billion. During the third quarter of 2010, the agency also estimated that the bill raised the GDP, lowered the unemployment rate, and increased the number of full-time jobs.

External links:

Report on the Troubled Asset Relief Program

Estimated Impact of ARRA on Employment and Economic Output

Last updated: May 11, 2021

Continue Reading

Related Content

News

Ignoring Costs Doesn’t Make Them Go Away

News

Debt Concerns Haunt “Big Beautiful Bill”

News

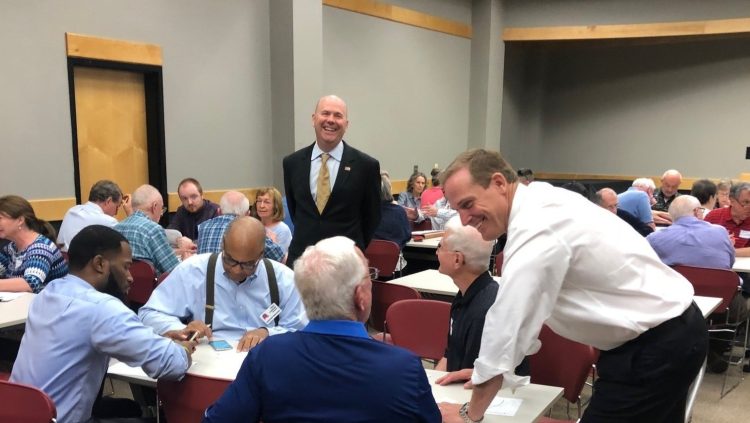

Coming to Agreement on the Federal Budget: Budget Exercise in Atlanta with WSB Radio’s Shelley Wynter

News

What’s Behind the Greenland Pitch?

News

House Republicans Propose Major Overhaul to Student Loan and Higher Education Financing

News

Budget Reconciliation Budget Gimmicks

News

GAO Flags Impoundment Act Violation

News

Moody’s Downgrades United States Credit

News

The Bumpy Road to Reconciliation

News

Too Many Tax Cuts; Not Enough Offsets

News

Reconciliation Gets Real

News

My Ride to Warn of Red Ink