Key Points

- New report from The Budget Lab at Yale explores how higher deficits impact inflation and interest rates.

- The permanent deficit increase that the report uses as its hypothetical is roughly the same size as the increase that would result from extending the TCJA tax cuts.

- The exact effects of an increase would depend on steps the Federal Reserve would take, but it is clear that sustained increases in the national debt will diminish the economic prospects of both current and future generations.

Last week, the Budget Lab at Yale released a report on the impact of higher deficits on inflation and interest rates. The report used several different economic models to estimate the potential effects of a permanent one percentage point increase in the primary budget deficit (a measure of the deficit that excludes the cost of interest on the national debt). The report concludes that higher deficits increase inflationary pressure in the economy, resulting in higher inflation and higher interest rates, although the precise results depend on how the Federal Reserve (“the Fed”) responds to rising prices.

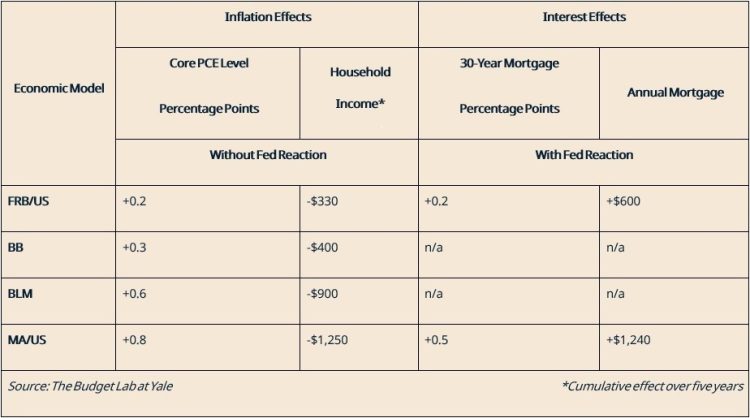

The table below summarizes some of the key findings from the report:

- Real (inflation adjusted) income would decline between $330 and $1,250 for the average household on a cumulative basis over the next five years, assuming the Fed did not increase interest rates to fight inflation.

- Alternatively, if the Fed did raise interest rates, then inflation would be lower, but interest rates would be higher. As a result, the cost of a 30-year mortgage for a median-priced home would increase between $600 and $1,240 per year.

It’s important to note that, per the authors of the report, these effects “are equivalent inflationary or interest rate effects in isolation; they do not incorporate the broader negative economic effects of debt on real income nor do they include the positive effects of our illustrative policy.”

Most economists agree higher deficits can adversely affect the economy. These adverse effects result from short-term changes in aggregate demand and long-term changes in investment. In the short term, government borrowing shifts money from savings to consumption, which can result in higher prices when combined with temporary supply constraints. In the long term, government borrowing crowds out private sector investment, in part due to higher interest rates, which reduce the capital stock, resulting in lower productivity and wage growth.

The different forecasting models used in the study show slightly different ways these effects could ultimately manifest in the economy. For example, the FRB/US model suggests a permanent one percentage point increase in the primary deficit would reduce the capital stock by four percent and total size of the economy (GNP) by one percent within 30 years, whereas the Solow Growth model suggests the capital stock would decline by nearly ten percent and the economy (GDP) would decline by three percent. The negative impact is larger in the Solow model because it does not account for international capital flows that partially offset the adverse effects of crowding out.

The illustrative policy path (a permanent one percent of GDP increase in primary deficits) is generic but the paper notes that it is roughly the same size as the effect of extending the individual provisions of the Tax Cuts and Jobs Act: “Whose costs through 2035 average to an increase in debt-to-GDP of slightly more than 1 percentage point of GDP a year against current law.” This makes the report a potential window into how Congress doing so would affect our economy and individual consumers.

The report highlights the range of uncertainty surrounding the short-term and long-term effects of higher deficits. But despite this uncertainty, the overall conclusion is clear: sustained increases in the national debt will diminish the economic prospects of both current and future generations.

Continue Reading