In the latest twist of fiscal illusionism, Senate Republicans have deployed a controversial accounting maneuver to make their reconciliation bill appear far less costly than it truly is. At the heart of the deception is the use of a “current policy” baseline—a gimmick that assumes expiring tax cuts will be extended indefinitely without cost, even though current law says otherwise.

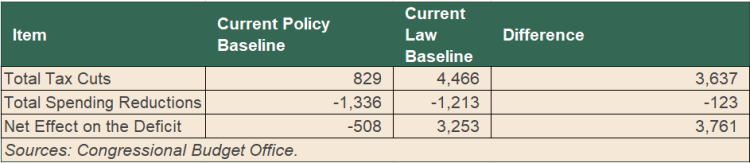

Here’s why that matters: under a traditional “current law” baseline, the Congressional Budget Office estimates that the Senate budget bill would add $3.3 trillion to the deficit over the next decade, largely due to the permanent extension of the 2017 tax cuts. But by instructing the CBO to use a current policy baseline, lawmakers effectively erased $3.8 trillion of that cost from the official score. As a result, the Senate bill that is currently being debated is shown to actually reduce the 10-year deficit by $508 billion.

Senate Reconciliation Bill Comparison (Dollars in Billions)

Impact on the Deficit, Positive (Increase), Negative (Decrease)

This isn’t just creative math—it’s a dangerous precedent. The reconciliation process was designed to enforce fiscal discipline, not to enable budgetary sleight-of-hand. By pretending that tax cuts are already permanent, the Senate bill opens the door for future deficit-busting bills. All they need to do is pass a “temporary” change (taxes or spending) with a limited cost and then make that change permanent the next year with no need to pay for it because it’s now“current policy.”.

For example, a proposal to further reduce taxes that costs $100 billion in the first year and $1 trillion over ten years could be set to expire after one year, so the cost when enacted would be $100 billion. The next year Congress could decide to make the provision permanent and under current policy baseline rules, making the change permanent would cost $0. In the real world, that change would cost $1 trillion over ten years. The only difference is that Congress would escape accountability for enacting a $1 trillion increase in the future deficits.

Even more troubling, the bill inconsistently applies this baseline. While the expiring 2017 tax provisions are scored under a current policy baseline, many of the new tax cuts, which have expiration dates, are measured against current law. This means that the new expiring tax cuts are not assumed to be permanent in the current policy baseline. This cherry-picking distorts the true tradeoffs and undermines the integrity of the budget process.

For example, the no tax on overtime provision is set to expire after 2028. The ten-year cost, with the expiration, is about $90 billion. However, a true current policy baseline, would assume the provision is permanent and include the total 10-year cost of $305 billion (2026-2028 cost of $90 billion plus 2029-2035 cost of $215 billion).

The result? A bill that looks fiscally palatable on paper but would, in reality, add trillions to the debt and further erode public trust in Congress’s ability to govern responsibly. It’s time to call this what it is: a budgetary bait-and-switch. Lawmakers should abandon the scoring charades and return to honest accounting. The American people deserve no less.

Continue Reading