As Congress pushes forward with the One Big Beautiful Bill Act (OBBBA), the numbers tell a troubling tale: the legislation keeps getting more expensive, even as the national debt spirals into uncharted territory.

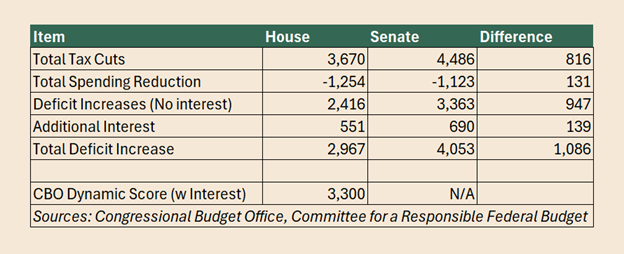

Comparison of House and Senate Versions of OBBBA (In billions of dollars)

According to the Congressional Budget Office (CBO), the House version already strained our fiscal capacity—offering $3.7 trillion in tax cuts with only $1.3 trillion in spending reductions. But the Senate version, which passed on July 1, goes further: it adds nearly $4.5 trillion in tax cuts and scales back offsets. That’s more than $4 trillion in new borrowing, at a time when the federal debt already exceeds 100% of GDP and interest payments are already larger than the entire budget for national defense.

CBO also released an analysis of the OBBBA version that passed the House using “dynamic scoring” that accounts for macroeconomic feedback. It found that the estimated positive economic effects from the tax cuts in the bill are completely offset by increased interest cost due to persistently higher interest rates. While dynamic effects usually decrease the cost of legislation, the CBO’s dynamic estimate indicates that the bill could cost up to $3.4 trillion over the next decade, over $442 billion more than the “static” estimate that did not consider dynamic economic effects. While CBO has not released a dynamic estimate of the Senate bill, similar effects are anticipated given that the Senate bill increases deficits more than the House bill.

What’s especially alarming is the trajectory: each iteration of the bill is larger and more detached from any coherent plan to pay for itself. The House at least nodded to fiscal rules. The Senate tosses them aside, relying on budget gimmicks like the “current policy baseline” to mask the full cost of extending tax cuts permanently.

Continue Reading