Key Points:

- Analysis from the CBO shows extending key provisions of the TCJA without offsets would increase the national debt from 99% of GDP to as high as 250% in 30 years, depending on interest rates.

- The Penn Wharton Budget Model estimates the U.S. economy can only withstand debt held by the public at a maximum ratio of 200% of GDP without catastrophic effects on the U.S. and world economies.

- These tax cuts must be fully paid for or they should not be extended at all, the cost – and risk – is far too high.

One of the major issues facing Congress this year is whether to extend key provisions of the Tax Cuts and Jobs Act (TCJA) which were enacted in 2017 and are scheduled to expire at the end of this year. Key provisions include a reduction in marginal tax rates, nearly doubling the standard deduction, and replacing the personal exemption with the child and dependent tax credit.

A recent analysis from the nonpartisan Congressional Budget Office (CBO) examines the long term implications of extending these provisions indefinitely – and the key takeaway is that this makes an already scary situation much, much worse.

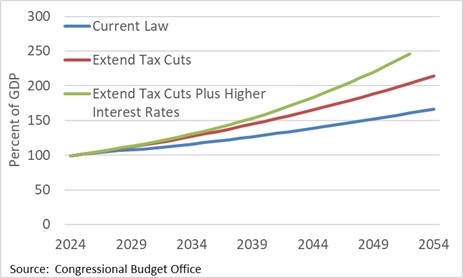

Under current law, in which the tax cuts expire, the national debt is projected to increase from 99 percent of GDP in 2024 to 166 percent in 2054. The rising level of debt is primarily due to the amount of borrowing needed to cover the cash-flow deficits of Social Security and Medicare, as well as the cost of paying interest on debt. (For purposes of this discussion, the national debt refers to the portion of the debt held by the public, which includes foreign and domestic investors, plus central banks like the Federal Reserve.)

If Congress permanently extends the expiring provisions of TCJA, federal revenue would be reduced by $21 trillion over the next 30 years. The additional borrowing needed to offset this revenue loss would result in an additional $16 trillion in interest payments, resulting in $37 trillion in additional debt. According to the Congressional Budget Office (CBO), that would increase the national debt to 214 percent of GDP in 2054.

The Penn Wharton Budget Model has projected that a debt-to-GDP ratio of 200 percent is the point where we will likely face a serious and potentially unsustainable financial crisis.

Under current law, CBO assumes the average interest rate on the national debt is less than four percent over the next 30 years. For reference, the interest rate right now on 10-year Treasuries is 4.3 percent, so current rates would need to fall to meet CBO’s assumption. But extending the tax cuts would result in higher deficits which lead to higher interest rates, thereby crowding out investment in the private sector. If interest rates were assumed to be one percentage point higher (before even accounting for the cost of extending the tax cuts) then the debt would exceed 250 percent by 2054.

As the latest CBO projections show, the cost of extending the expiring tax cuts is simply too big to ignore. Congress should avoid using budget gimmicks like the current policy baseline to pretend this cost does not exist, and must fully pay for these tax cuts, or not extend them at all.

National Debt as a Percent of GDP under Alternative Scenarios

Continue Reading