Concord Action welcomes a variety of viewpoints on issues related to the long-term fiscal health of the nation. The following is a guest essay written by economist Diane Lim who was most recently the Director of the Equity Hub at the U.S. Department of Treasury.

Two of the biggest criticisms of H.R. 1, or the One Big Beautiful Bill Act (OBBBA) passed by the House last month and the Senate last week, are: (i) the total budgetary cost of the bill, CBO estimates $4.0 trillion over 10 years (including interest); and (ii) the unfairness of the highly skewed distribution of who would benefit from the tax cuts and who would lose from the cuts to programs. But combining these two analytical conclusions—it costs too much, and benefits mostly the richest—shows the proposal is also inefficient and unwise as an economic policy.

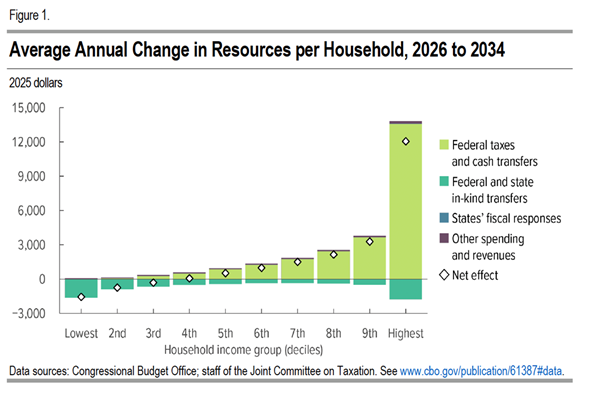

CBO’s distributional analysis shows the proposed legislation to be highly regressive, redistributing income from lower- and middle-income households to the richest households, both in absolute dollar terms and in percentage change of income terms. It is the distribution of dollar net benefits that shows us how the overall cost of the bill (what can be considered the public “investment” in this overall policy) is distributed:

The average net dollar gain in income to households in the top 10% of the income distribution is over $12,000 (per year), while the average net dollar loss of income to households in the bottom 10% is over $1,500. For perspective, that means that $12,000/$1,500 = 8 households in the bottom 10% are effectively paying for the tax cut of one household in the top 10%.

How did this bill get designed this way?

Well, first it’s a big tax cut bill. Any big tax cut will benefit the taxpayers who under current law pay the most in taxes, but especially so for an extension of prior tax cuts (the Tax Cuts and Jobs Act of 2017) that were already skewed toward tax cuts at the top. The federal income tax is a progressive tax system where tax burdens as a share of income rise with income. A large tax cut raises after-tax incomes on average across all households, but the gains in income are not at all evenly distributed across the income distribution because current-law tax liabilities are not evenly distributed. Cutting the income tax in an across-the-board, neutral way will thus naturally benefit higher-income households more than lower-income households (in both absolute and relative to income terms).

And second, it’s a bill that cuts economic security/income support programs. OBBBA also cuts spending on programs that support only lower-income families, such as the Medicaid and food assistance (SNAP) programs. The households that rely on these support programs earn too little income to owe federal income taxes and hence would not benefit from any of the tax cuts.

Could there be economic benefits that justify these costs? But presumably, proponents of OBBBA characterize this bill as “beautiful” for reasons other than its high budgetary cost and regressive redistribution of income. They argue that these costs and the distribution of costs will pay off in future years by encouraging stronger overall, macroeconomic growth—which is a traditional “supply side” or “trickle down” theory from the 1970s and 80s that says the best way to grow the productive capacity of the economy is to give more money to those at the top who have already have demonstrated the most success in the economy (already have the most income and wealth). But the empirical evidence about who will get the bulk of the tax cuts and how those people are likely to change their behavior—as opposed to enjoying the increases in their income—runs overwhelmingly contrary to this theoretical premise.

If we really care about maximizing and tapping into our collective yet underutilized economic potential, we should be looking toward policies that lower barriers to everyone participating in the supply side of our economy. This is a concept that former Secretary of the Treasury Janet Yellen labeled “modern supply side economics” (MSSE) (in January 2022). That MSSE strategy recognizes that a marginal dollar provided to a low-income individual, in the form of a program that can lower real barriers and obstacles to economic opportunity, will likely have more of an effect on our overall economic capacity and activity than a marginal dollar either taken from (or given to) a high-income individual who is already operating at their unfettered “full potential.” For example, providing health care (via Medicaid or a tax credit to help pay for health insurance) or food assistance to a family with limited income can make it possible for them to more easily afford work-related expenses (such as transportation or child care services), which can in turn make them more likely to be able to pursue employment opportunities to earn more income. In contrast, providing a high-income household who is already fully employed with an additional tax cut will not change their work opportunities and outcomes, but will merely raise their after-tax income.

The (huge) deficit financing of OBBBA makes the bill even worse as an economic growth strategy. Deficit financing means we are borrowing from the future to pay for policy priorities today—in this case, tax cuts skewed to high-income taxpayers. This redistribution of resources from the young (who have entire lifetimes of productive work and contributions ahead of them) to the old (who are in or near to retirement) is the opposite of investing in our future economy. It is not just unfair to the young and future generations, it is unwise. And any future efforts to reduce the deficit with further cuts to the size and role of the federal government (which is still overall redistributive/progressive accounting for all its revenue and spending programs) will only further increase inequality, redistributing income further from the poor and towards the rich.

So, while the Trump bill is indeed Big, there is nothing Beautiful about it, and the ugliness goes beyond the price tag and the blatant and gross (pun intended) redistribution of income it would impose. It is an ugly, wasteful, anti-growth economic strategy that will only further constrain and challenge our collective economic future.

Continue Reading